Investment incentives Governmental grants

Investment incentives Governmental grantsForm of support

- setting-up of a new establishment

- extending the capacity of an existing establishment

- diversification of the output of an establishment into products not previously produced in the establishment

- fundamental change in the overall production process of an existing establishment

- the acquisition of assets belonging to an establishment that has closed or would have closed had it not been purchased, and is bought by an investor unrelated to the seller

1. The number of jobs created (employment grant)

- A Business Service Center;

- A Research and Development Service Center.

| Type of investment | Minimum eligible costs (m PLN) | Minimum new employment | Maximum support (per each new job created, in PLN) | Type of processes |

| Business Service Center | 1 | 100 | 15,0001 / 7,500 | Intermediate, advanced and highly advanced services (specified in Annex 2 to the Program) |

| Research and Development Service Center | 1 | 102 | up to 40,0003 / up to 30,0004 / up to 20,0001 / up to 15,0005 | R&D services (specified in Annex 2 to the Program) |

2for those with higher education

3in the case of creating at least 200 new jobs or having the status of a Research and Development Centre in accordance with the Act of 30 May 2008 on certain forms of support for innovative activities, regardless of the location of the investment

4in the case at least 100 new jobs being created, regardless of the location of the investment

5in the case of locating the investment in the rest of the country

2. Investment costs (investment grant)

- Strategic;

- Innovative;

- in a Research and Development Services Center.

| Type of investment | Minimum eligible costs (m PLN) | Minimum new employment | Maximum support (as % of eligible costs) |

| Strategic | 160 | 50 | - micro-entrepreneur / small entrepreneur: 25%1 / 15%5 - medium-sized entrepreneur / developing entrepreneur: 20%1 / 10%5 - large entrepreneur: 15%1 / 5%5 |

| Innovative | 7 | 20 | |

| Research and Development Service Center | 1 | 106 | 25%7 / 15%8 |

5in the case of locating the investment in the rest of the country

6for those with higher education

7in the case of locating the investment in the area of the country where the maximum regional aid intensity is 50% or in an area at risk of exclusion

8in the case of locating the investment in the rest of the country

3. Increased support for employee training

The amount of the increase in support per employee may amount to a maximum of:

- PLN 7,000 - in the case of locating the investment in the area of the country where the maximum regional aid intensity is 50%, or in an area at risk of exclusion;

- PLN 5,000 - in the case of locating the investment in in the rest of the country.

An entrepreneur may receive support in the case of obtaining at least:

- 4 points - in the case of locating the investment in the area of the country where the maximum regional aid [in accordance with the regulation issued on the basis of Article 10(2) of the Act of 30 April 2004 on proceedings in cases concerning State Aid] intensity is 50% or in an area at risk of exclusion;

- 5 points - in the case of locating the investment in the area of the country where the maximum regional aid intensity is 30% and 40%;

- 6 points - in the case of locating the investment in the rest of the country.

- Type of processes performed

- Conducting R+D activities

- Utilization of the potential of human resources

- Robotization and process automation

- Status of a micro, small or medium-sized entrepreneur

- Creating highly-paid and stable workplaces

- Investment in a building with low negative impact on the environment

- Supporting the territorially balanced development of the country

- Supporting the acquisition of education and professional qualifications and cooperation with sectoral education

- Taking care of employee welfare

- Investment in a strategic sector

- Utilization of the potential of human resources

- Robotization and process automation

- Conducting R+D activities

- Investment in RES

- Status of a micro, small or medium-sized entrepreneur

- Creating specialised workplaces

- Running a business with a low negative impact on the environment

- Territorially balanced development

- Supporting the acquisition of education and professional qualifications and cooperation with sectoral education

- Taking care of employee welfare

A large enterprise is obliged to incur costs in the field of cooperation with Institutions of Higher Education in the amount of at least 15% of the value of the granted support.

Cooperation with entities forming the Higher Education system within the meaning of Article 7 of the Act of 20 July 2018 - Law on Higher Education and Science consists in:

- commissioning scientific research or development work;

- sponsorship of scientific research;

- commissioning the implementation of education programs;

- participation in the programme of the Minister responsible for Higher Education and Science "Implementation Doctorate" and other programmes or undertakings of the Minister responsible for Higher Education and Science related to the implementation of Doctoral Institutes;

- financing the participation of students and pupils in the practical education process, including, among other things, in the form of dual education, through scholarships, organising internships or employment;

- participation in research consortia co-financed by the National Centre for Research and Development;

- purchase of patents and licenses from entities forming the higher education and science system or their special purpose vehicles;

- equipping entities forming the higher education and science system, within the meaning of Article 7 of the Act of 20 July 2018 - Law on Higher Education and Science, with laboratory equipment necessary to conduct research, didactic tasks or practical classes;

- equipping Higher Educational Institutes with the equipment necessary to carry out teaching or practical tasks;

- co-organizing within Institutes of Higher Education and co-financing student training centers offering specialized courses aimed at improving the competences required in the business activity conducted by the entrepreneur.

The operator of the Programme and the authority granting State Aid is the Minister responsible for the economy (currently: Minister of Development and Technology). The Polish Investment and Trade Agency (Polska Agencja Inwestycji i Handlu S.A.) is responsible for preparing and providing the Interministerial Committee for Investments of Major Importance to the Polish Economy (hereinafter referred to as the Committee) with the dossier of investment projects and for preparing all the documents required to carry out the entire procedure of providing financial support.

The Investment Department (DI) is responsible for providing information on Government Grants.

The DI is not only the operator of the Programme, but also supports investors in the following ways. Get to know the offer »

- PAIH:

- application form completed in Polish (Information about the project),

- analysis of the incentive effect* (for large enterprises),

- attachments,

- a copy of the application submitted to the Minister responsible for the economy.

- Minister responsible for the economy:

- application for State Aid with necessary attachments.

- analyzes the data presented by the entrepreneur in terms of meeting the formal requirements of the Program,

- prepares a project description including an assessment of the investment and the amount of support proposed on its basis, together with justification.

The entrepreneur has 30 days, from the date of delivery of the information from the Minister responsible for the economy, to submit a declaration of acceptance of the proposed amount of support.

If the proposed amount of support is accepted, the Minister responsible for the economy concludes an Agreement with the entrepreneur.

* Incentive effect analysis (feasibility study of the project) - in accordance with Article 6 of Commission Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty, when applying for regional investment aid, a large enterprise must demonstrate that:

- Without support, the project will be implemented in another country. This requires a comparative analysis of the scenario of investment implementation in Poland and another country, together with a detailed calculation of the State Aid that can be obtained, or

- Without the support received, the investment project would not bring sufficient benefits to the beneficiary. This requires a comparative analysis of the profitability of investment implementation (based on NPV and IRR indicators) in Poland with and without aid received.

State Aid offered under the Programme is consistent with the rules on the award of State Aid in the EU, that is with the Guidelines on regional State Aid (Official Journal of the European Union, C 153, 29 April 2021) and Commission Regulation (EC) no. 651/2014 of 17th June 2014 declaring certain categories of aid compatible with the common market in application of Articles 107 and 108 of the Treaty (Official Journal of the European Communities L 187 of 26th June 2014, page 1). Aid that does not comply with the Regulation requirements may be granted after approval of the European Commission in line with the procedures specified in the Guidelines on regional aid for 2014-2020.

Attachments:

Definitions

‘initial investment’ means:

a) an investment in tangible and intangible assets related to the setting-up of a new establishment, extension of the capacity of an existing establishment, diversification of the output of an establishment into products not previously produced in the establishment or a fundamental change in the overall production process of an existing establishment; or

b) an acquisition of assets belonging to an establishment that has closed or would have closed had it not been purchased, and is bought by an investor unrelated to the seller and excludes sole acquisition of the shares of an undertaking.

The ‘eligible costs’ shall be as follows:

a) investment costs in tangible and intangible assets;

b) the estimated wage costs arising from job creation as a result of an initial investment, calculated over a period of two years; or

c) a combination of points (a) and (b) not exceeding the amount of (a) or (b), whichever is higher.

An area at risk of exclusion (Location of the investment):

a) in a medium-sized city losing its socio-economic functions, listed in Table 3 in Annex 1 to the Regulation of the Council of Ministers of 27 December 2022 on public aid granted to certain entrepreneurs for the implementation of new investments, or

b) in the municipality in which the city referred to in point (a) is situated, or

c) in a municipality bordering a town referred to in point (a) or a municipality referred to in point (b), or

d) in Powiats or cities with powiat status, where the unemployment rate is at least 160% of the average unemployment rate in the country,

- excluding cities in which the seat of the Voivode or the Voivodship Parliament is located.

What projects cannot count on support?

A detailed catalog of exclusions is specified in Art. 13 of Commission Regulation (EU) No. 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty.

According to the above, aid cannot be granted to investments in, inter alia, the iron and steel sector, the coal sector, the shipbuilding sector, the synthetic fibers sector, the transport sector as well as the related infrastructure, energy generation, distribution and infrastructure. Regulations of the aforementioned Regulation also shall not apply to individual regional investment aid to a beneficiary that has closed down the same or a similar activity in the European Economic Area in the two years preceding its application for regional investment aid or which, at the time of the aid application, has concrete plans to close down such an activity within a period of up to two years after the initial investment for which aid is requested is completed in the area concerned.

How to determine the company's status?

In accordance with the Commission’s Regulation (EU) No 651/2014 of 17 June 2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty, the following evaluation criteria were adopted for the purposes of defining the size of enterprises: number of employees, turnover, balance sheet total, and autonomy. Turnover and balance sheet total are alternative criteria. On this basis, the following category of enterprises have been established:

- CategoryMedium

Small

Micro - Average annual number of employed< 250

< 50

< 10and - Yearly

turnover≤ EUR 50 mln

≤ EUR 10 mln

≤ EUR 2 mlnor - Total annual

balance≤ EUR 43 mln

≤ EUR 10 mln

≤ EUR 2 mln

Companies that do not qualify as micro, small or medium enterprise are classified as large companies and growing companies*.

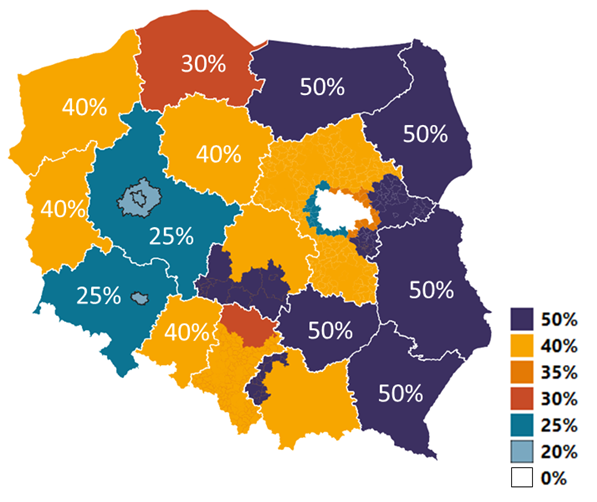

Map of regional aid intensity

Łódzkie region: 50% of support available in parts of Piotrkowski and Sieradzki regions.

SMEs: Medium companies can benefit from 10% more of support. Small companies can benefit from additional +10% (+20% in total).

Can State Aid be cumulated?

Yes. The cumulation of State Aid is provided for in Article 8 of the GBER:

„Article 8 - Cumulation

- In determining whether the notification thresholds in Article 4 and the maximum aid intensities in Chapter III are respected, the total amount of State aid for the aided activity or project or undertaking shall be taken into account.

- Where Union funding centrally managed by the institutions, agencies, joint undertakings or other bodies of the Union that is not directly or indirectly under the control of the Member State is combined with State aid, only the latter shall be considered for determining whether notification thresholds and maximum aid intensities or maximum aid amounts are respected, provided that the total amount of public funding granted in relation to the same eligible costs does not exceed the most favourable funding rate laid down in the applicable rules of Union law.

- Aid with identifiable eligible costs exempted by this Regulation may be cumulated with:

a) any other State aid, as long as those measures concern different identifiable eligible costs;

b) any other State aid, in relation to the same eligible costs, partly or fully overlapping, only if such cumulation does not result in exceeding the highest aid intensity or aid amount applicable to this aid under this Regulation. - Aid without identifiable eligible costs exempted under Articles 21, 22 and 23 of this Regulation may be cumulated with any other State aid with identifiable eligible costs. Aid without identifiable eligible costs may be cumulated with any other State aid without identifiable eligible costs, up to the highest relevant total financing threshold fixed in the specific circumstances of each case by this or another block exemption regulation or decision adopted by the Commission.

- State aid exempted under this Regulation shall not be cumulated with any de minimis aid in respect of the same eligible costs if such cumulation would result in an aid intensity exceeding those laid down in Chapter III of this Regulation.

- By way of derogation from paragraph 3(b), aid in favour of workers with disabilities, as provided for in Articles 33 and 34 may be cumulated with other aid exempted under this Regulation in relation to the same eligible costs above the highest applicable threshold under this Regulation, provided that such cumulation does not result in an aid intensity exceeding 100% of the relevant costs over any period for which the workers concerned are employed.”

What if I do not complete the investment in full?

It is possible to reduce the value of investment costs by up to 40% and the number of newly created jobs by a maximum of 40%, however, the amount of investment costs declared or the number of new jobs may not be lower than the minimum thresholds for applying for support for specific types of investments specified in the Programme.

The costs related to the training of staff may be reduced, in which case the amount of support shall be recalculated in accordance with the rules laid down in the Programme.

In the case of combining support instruments, the reduced value of investment costs or the number of newly created jobs may not be lower than the minimum conditions for combining support instruments, or support under the Programme must be limited to PLN 3 million.

The minimum values of investment costs or the number of newly created jobs after their reduction are set in the Agreement.

In the event of a reduction in the investment parameter for which support is granted, the amount of support shall be recalculated in accordance with the rules set out in the Programme.

Programme (in Polish): Program wspierania inwestycji o istotnym znaczeniu dla gospodarki polskiej 2011-2030 - Uchwała RM nr 91/2023 z 5.06.2023 r.

(Last updated: June 20, 2023)